Pound watchers refuse to rule out no-deal twist in Brexit climax

News24

18 Oct 2019, 19:13 GMT+10

Currency strategists are ruling nothing out for Saturday's crucial parliamentary vote on Britain's deal to exit the European Union - and that makes forecasting where sterling will settle something of a crapshoot.

The pound could surge to $1.35 or slip to around $1.26, strategists and fund managers say as they assess the range of possible outcomes from Brexit's climactic moment.

Sterling already jumped 5% this month to around $1.29 and now it's pinned to that marker as traders wait to see if Prime Minister Boris Johnson can convince sceptics in the House of Commons to approve the divorce deal he sealed this week. It's fine margins, and if he can't, that opens the door to other scenarios including an election, a second referendum, or even a move to leave the EU with no agreement in place.

While Johnson's accord has lowered the likelihood of a no-deal Brexit on October 31, the risks "are not mathematically zero," say strategists at Toronto-Dominion Bank, including Ned Rumpeltin.

EU and UK say they have reached a deal on Brexit

"Any positions predicated on an imminent no-deal crash-out look difficult to countenance at this stage," said Rumpeltin, the European head of currency strategy at TD. "Looking forward however, we think it is still a little too early to sound an unqualified all-clear."

If Parliament does manage to pass the deal this week, the pound could test May's peak of around $1.3185, the TD strategists forecast, though they see it struggling to move higher in the absence of fresh catalysts.

UBS Global Wealth Management is more bullish. It's retaining an overweight position in sterling against the dollar, said Chief Investment Officer Mark Haefele. A "convincing deal" could drive the pound to $1.35, he predicted.

Searching for votes

Johnson needs 61 of 85 possible votes from potential swing lawmakers, a tight but feasible number. One blow is that Northern Ireland's Democratic Unionist Party, with 10 potential supporters, came out firmly against the deal.

If lawmakers were to reject it and that led to an extension beyond the Octover 31 Brexit deadline, the risk of a general election would "suck the wind" out of sterling's rally and see it test $1.2640-60, the TD strategists predict. And that level could come under significant pressure if Parliament's blocking of the deal were followed by the EU rejecting a request for an extension to the Brexit deadline.

Other scenarios - including a potential second referendum that could cancel Brexit altogether, or an election that could cement Johnson's leadership and seal his deal - cannot be ruled out either.

No wonder implied volatility on sterling is so high and risk gauges are swinging back and forth. And adding to the drama, the currency market won't get its first chance to react to the twists and turns of the weekend until trading resumes at 7 p.m. local time (or 7 a.m. in Auckland), when liquidity can be limited and exacerbate price swings.

"No deal remains a threat until either a deal or no Brexit is completed," Rumpeltin said. "An unexpected jump to an alternative scenario would quickly return both rates and FX to the state of confusion and - often - contradiction that has defined much of the Brexit process so far."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dublin News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dublin News.

More InformationBusiness

SectionBrazil aims to restart poultry trade after bird flu clearance

SAO PAULO, Brazil: Brazil is taking confident steps to restore its dominance in global poultry exports after declaring its commercial...

U.S. stocks restricted by tensions in Middle East

NEW YORK, New YorK - U.S. stocks closed mixed on Friday, with gains and losses modest, as investors and traders weighed up the escalation...

US consumers cut back after early surge ahead of Trump tariffs

WASHINGTON, D.C.: Retail sales dropped sharply in May as consumer spending slowed after a strong start to the year, primarily due to...

Mitsubishi joins automakers raising prices after import tariffs

WASHINGTON, D.C.: Mitsubishi Motors is the latest automaker to raise prices in the United States, joining a growing list of car companies...

Lilly makes $1.3 billion move to expand into gene-edited heart drugs

INDIANAPOLIS, Indiana: Eli Lilly is making a bold play in cardiovascular gene therapy, announcing plans to acquire its partner Verve...

New Zealand PM seeks stronger ties with China amid security talks

BEIJING/WELLINGTON: New Zealand's Prime Minister Christopher Luxon commenced his visit to China on June 17, seeking to strengthen trade...

Europe

SectionSenator Duffy lauds proposed laws against vaping in Ireland

DUBLIN, Ireland: Fine Gael Senator Mark Duffy says new laws to regulate vaping products will help make them less attractive to young...

REE misjudgment caused April blackout, says Spain's energy chief

MADRID, Spain: A routine oversight by Spain's power grid operator, REE, has been identified as the trigger behind the large-scale blackout...

Ireland MP Paul Murphy released by Egyptian authorities on June 16

DUBLIN, Ireland: Egyptian authorities released Paul Murphy, TD, from the People Before Profit party after his second detention on June...

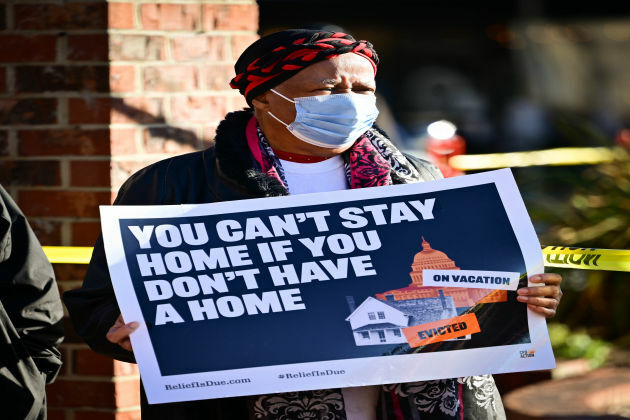

Demonstrators in Dublin decry homes as investment assets, not shelter

DUBLIN, Ireland: In a significant demonstration outside Leinster House in Dublin, hundreds of housing protesters voiced their frustration...

Aircraft orders expected as Paris airshow opens, despite recent crises

PARIS, France: The Paris Airshow kicked off on June 16, attracting attention with expected aircraft orders, but overshadowed by the...

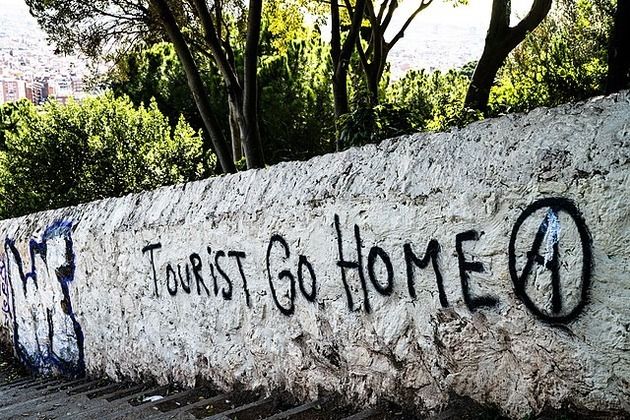

'Tourists go home': Anti-over-tourism protests erupt in Barcelona

BARCELONA/MADRID, Spain: With another record-breaking tourist season underway, thousands of residents across southern Europe marched...