Dozens of US banks at risk of repeating SVB collapse study

RT.com

18 Mar 2023, 19:43 GMT+10

Many other lenders are also sitting on unrealized losses caused by the rapid rise in interest rates

Nearly 200 American banks are facing risks similar to what led to the implosion and bankruptcy of Silicon Valley Bank (SVB), according to a paper posted this week to the Social Science Research Network. SVB, a major US lender focused on the tech and startup sectors, was shut down by regulators last week after massive deposit outflows.

In the study, four economists from prominent US universities estimated how much market value the assets held by US banks have lost due to the recent interest rate hikes.

"From March 07, 2022, to March 6, 2023, the federal funds rate rose sharply from 0.08% to 4.57%, and this increase was accompanied by quantitative tightening. As a result, long-dated assets similar to those held on bank balance sheets experienced significant value declines during the same period," they wrote.

Although higher interest rates can benefit banks by allowing them to lend at a higher rate, many US banks have parked a significant portion of their excess cash in US Treasuries. This was done when interest rates were at near-zero levels. The value of these bonds has now greatly decreased due to the rate hikes - investors can simply purchase newly issued bonds that offer a higher interest rate. The decline in the banks' portfolios is unrealized, meaning the value has declined but the loss is still only 'on paper'.

The problem arises when customers request their deposits back and banks are forced to sell their securities - at a significant loss - in order to pay depositors back. In extreme cases, this can lead to a bank becoming insolvent, or as happened with Silicon Valley Bank, the loss of confidence this circumstance engenders can trigger a bank run.

The report's authors looked into the ratio of US lenders' funding from uninsured deposits: the greater the share of uninsured deposits, the more susceptible a bank is to a run. For instance, at SVB, where 92.5% of deposits were uninsured, the deposit outflow caused the bank to collapse in a span of only two days. The authors of the study calculated that 186 American banks do not have enough assets to pay all customers if even half of uninsured depositors decide to withdraw their money.

"Our calculations suggest these banks are certainly at a potential risk of a run, absent other government intervention or recapitalization... Overall, these calculations suggest that recent declines in bank asset values very significantly increased the fragility of the US banking system to uninsured depositor runs," the economists concluded, noting that the number of banks at risk could be "significantly" larger if "uninsured deposit withdrawals cause even small fire sales."

SVB's failure sent ripples across the entire US banking industry and caused the closure of another lender, Signature Bank. Many other financial institutions have seen their stocks plunge, with the six largest Wall Street banks losing around $165 billion in market capitalization, or some 13% of their combined value. Earlier this week, the ratings agency Moody's downgraded its outlook for the US banking system from 'stable' to 'negative', citing the "rapidly deteriorating operating environment."

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Dublin News news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Dublin News.

More InformationBusiness

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Europe

SectionNurses in Ireland sound alarm over growing hospital overcrowding

DUBLIN, Ireland: The Irish Nurses and Midwives Organisation (INMO) has warned that there could be a serious trolley crisis this summer...

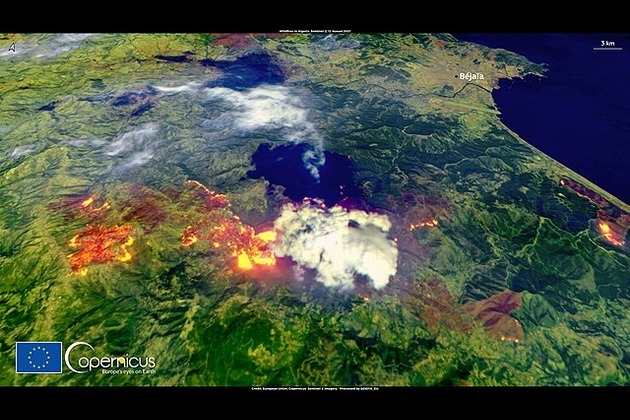

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Dublin court lifts anonymity for Trinity College in plagiarism case

DUBLIN, Ireland: The High Court has lifted an anonymity order, allowing Trinity College Dublin and the Pharmaceutical Society of Ireland...

New French law targets smoking near schools, public spaces

PARIS, France: France is taking stronger steps to reduce smoking. A new health rule announced on Saturday will soon ban smoking in...

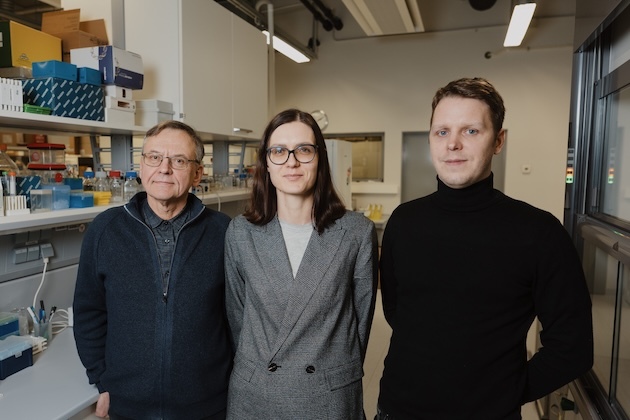

Methionine Restriction Could Extend Lifespan, Boost Health

VILNIUS, Lithuania – A growing body of research suggests that selectively restricting a single nutrient in our diet could have profound...